Bitcoin rose sixfold within six months; digital titles to works of art are being sold for millions of Dollars; and the central banks of the leading countries are getting ready to issue national cryptocurrencies that Bitcoin will have to compete with.

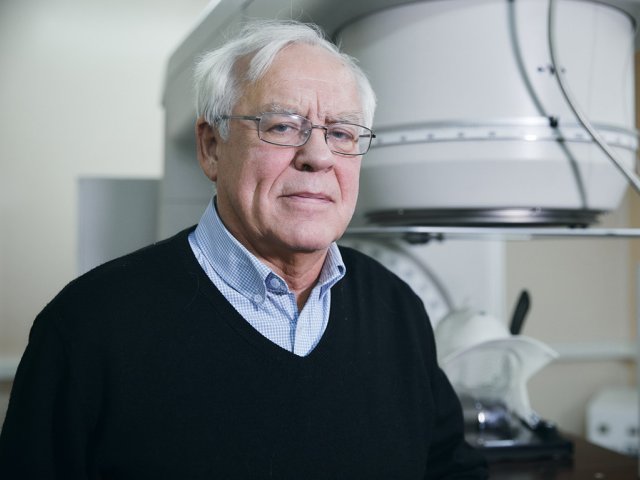

In this interview, Mikhail Golovnin, Correspondent Member of the Russian Academy of Sciences, Senior Deputy Director of the RAS Institute of Economics, spoke of the causes of the unprecedented appreciation of the most popular cryptocurrency, about the position of the Central Bank on the digital assets market, and the outlook for blockchain economy.

Mikhail Golovnin, Correspondent Member of the Russian Academy of Sciences, Senior Deputy Director of the RAS Institute of Economics

Photo: Nikolay Mokhnachev / Scientific Russia

- The existing cryptocurrencies, such as Bitcoin, etc., how do economists feel about them? Is a cryptocurrency considered to be money?

- There is a long ongoing discussion on this subject. The term “cryptocurrency” implies that it is money: we normally use the word “currency” to refer to money of a foreign state. Let’s get back to history: Friedrich August von Hayek, a famous Austrian economist, wrote the book titled The Denationalization of Money, which is often mentioned in relation to Bitcoin and other cryptocurrencies.

Until recently, we essentially lived in a world where there was just state money, circulating within a particular country. However, there was still competition between currencies. For instance, there was a massive de-dollarization in the Russian economy in the 1990s. This is an example of how a foreign currency can perform individual functions of money in our country.

Those individual money functions may be performed by other instruments, not necessarily issued by the state, e.g., by cryptocurrencies. Bitcoin is based on blockchain technology, and cryptocurrencies are issued by private entities.

Cryptocurrencies certainly perform some money functions. But those functions are limited, primarily by nation states where the cryptocurrencies circulate. The central banks of those states have no wish to lose their monopoly on the legal tender, i.e., on their national currencies.

There is a struggle between Bitcoin, which is, essentially, a supranational currency, and individual national currencies. If we get back to the idea put forward by Friedrich, this is a competition between private and state money.

- And what is the level of this competition in Russia now? What’s the position of the Central Bank?

- The law on digital financial assets became effective as of January 1, 2021. There had been discussions as to how to construe cryptocurrencies. Now, there is a definite legal framework. I wouldn’t say that the law put a period on the matter. On the contrary, there is a number of suspension points there. On the one hand, digital financial assets are now in the legislative environment. On the other hand, there are a lot of contradictions.

The law recognizes cryptocurrencies as an instrument of payment, but says that they cannot be used to pay for goods and services within the Russian Federation. The law says that cryptocurrencies are an investment vehicle; value preservation is one of the money functions, but they are not officially considered money in the Russian Federation. There are rigid rules of declaring cryptocurrencies and associated revenue, but multiple questions remain open.

Therefore, the stance of the Central Bank is ambivalent to a degree. On the one hand, it is about protecting the national currency monopoly. All the more so because the most serious symptoms of dollarization have finally disappeared in the country; the Ruble has started circulating in Russia; Ruble bank deposits are increasing. And now, all of a sudden, there are new instruments that may shake the Ruble’s position.

On the other hand, credit should be given where credit is due: the Central Bank does realize that digital technologies that are at the core of cryptocurrencies, are developing. In this regard, the Central Bank took the same path as most central banks of leading countries did: it started developing a national digital currency. There is a report on the digital Ruble, which was discussed at the end of the last year, and the Digital Ruble Concept presented by the Central Bank on April 8 underlines that the issue will become a practical matter.

What has to be understood is that Bitcoin and the digital Ruble are different currencies. The difference between them is in their respective operation principles: Bitcoin has multiple circulation control based on blockchain technology, while national digital currencies will have centralized settlement infrastructure. But technologies used in digital currencies have one common advantage, which is saving on payment system expenses.

The entrance to the building of the RAS Institute of Economics

Photo: Nikolay Mokhnachev / Scientific Russia

The building of the RAS Institute of Economics

Photo: Nikolay Mokhnachev / Scientific Russia

- What is the digital Ruble going to be backed with?

- The digital Ruble will be backed by the ordinary Ruble – it is one of the aspects of the same currency, just a different form of money.

In terms of the theory of money, money is often divided into two categories: commodity money and Fiat money. Commodity money is mentioned when we are talking about gold, for instance. While all modern money is unbacked, Fiat money. But now, unbacked money starts coming in different forms: there is cash, money in bank accounts, reserves of commercial banks in the Central Bank (separately), and less liquid instruments. It is important to see the entire range existing today. Essentially, the share of cash is shrinking to a serious degree, and many researchers say that the progress towards the digital Ruble is another way to fight the circulation of cash.

The advantage of cash is anonymity. Bitcoin has this advantage as well. With the digital Ruble, on the other hand, every transaction will be registered and every payment tracked.

- In December, one Bitcoin cost around $26,000; its price went over $63,000 in April and has kept around this mark to this day. Why did the price double?

- Actually, the price rose sixfold: before October last year, the Bitcoin exchange rate stayed within the range of $10,000 to $11,000. The rate went up 600 percent over six months – an unprecedented spike in the history of Bitcoin. There were quite a lot factors behind that.

Firstly, another global economic crisis, which is still ongoing. By the way, Bitcoin emerged on the back of the previous crisis of 2007-2009. And we can see it appreciating in the midst of another crisis.

To a degree, this is a reflection of what investors see in Bitcoin: many call it digital gold, i.e., it’s a chase after a stable asset. But, unlike gold, Bitcoin does not have its material form; it’s all about confidence factor. Sometimes, people stop trusting centralized mechanisms and focus on decentralized ones instead – this is one factor.

On the other hand, we can see a clear speculative component. There was a gigantic liquidity pumping in the leading currencies, primarily in the US Dollars and Euro. The money had to move to some markets anyway: it did not go into the real sector due to the continuing economic recession, so it went into financial markets. We see stocks skyrocketing, first and foremost on the American market, and we also see Bitcoin going up.

I would mention another thing as well: when Bitcoin starts rising, that draws attention. At present, Bitcoin is being gradually integrated into the system of financial institutions and interconnections. A notable example: At least two banks making transactions in cryptocurrencies were registered in the USA this year. These are the first steps of Bitcoin as it penetrates the existing financial infrastructure.

There are striking statements, e.g., the one about Tesla investing $1.5 billion in Bitcoin. If other companies join, the demand will go up. The supply of Bitcoin was limited. Bitcoin mining was limited to 21 million. But now, according to various estimates, around 18.5 million Bitcoins have been mined. In addition, a lot of Bitcoins are not in circulation, and when the speculative demand goes up, we see the value of the total mass rising.

Photo: Nikolay Mokhnachev / Scientific Russia

- When we say Bitcoin, do we also imply other cryptocurrencies, of which there are hundreds now: Ethereum, Dogecoin, and others?

- I would say, there are thousands of cryptocurrencies. They are very different, but as far as Ethereum and other sufficiently capitalized altcoins are concerned, then the answer is yes – the rise in Bitcoin reflects on those as well. Bitcoin, as the pioneer of cryptocurrencies, drives various trends and changes in Bitcoin reflect on the altcoin market.

- There was a number of impressive transactions in NFT – the non-fungible tokens. For example, the Everydays: The First 5000 Days painting in the digital form was purchased for $69 million. A gray pixel was sold recently for $1 million. Is it safe to say that the NFT technology ensures property rights completely, or does it depend on the country of the transaction?

- NFT is a technology designed for the registration of digital titles to works of art in a very broad sense. As is the case with the cryptocurrencies, the system is quite convenient. It has begun spreading fast and is progressing together with the rise of Bitcoin: this is what is called by this slang word “hype” – heightened enthusiasm about such phenomena also pushes the prices at digital auctions.

In terms of general regulation, there are gaps, i.e., there may be some fraud – there have been some cases of that.

- How do tax authorities respond to NFT transactions? For instance, what if I sold a painting in a digital form, and then exchanged the cryptocurrency for real assets. Is this income?

- I’ll tell you how movement of cryptocurrency is regulated in theory and from the logical viewpoint.

How is tax calculated on any security? You pay income tax on the difference between the amount you sold it for and the amount you paid for it. The current legislation applies roughly the same logic to cryptocurrencies. When the prices rise sharply, you can buy at one price and sell at another – the government is trying to tax such income.

There remain unresolved issues though, e.g., taxation of miners, i.e., those who mine Bitcoin.

The same logic should apply to the movement of digital rights. But I haven’t heard of digital rights being resold yet.

- What could one predict with regard to digital currencies? Is it going to stay in the economic market or could it fold if the people’s trust the supports this system runs out?

- Most of the current forecasts tend to be overoptimistic, even predicting the price of Bitcoin reaching 6-digit numbers in Dollars. But that’s one extreme, another opinion being that it is all a bubble and it is going to burst. My stance is neutral.

Cryptocurrencies will certainly stay. In all likelihood, they will be increasingly present in the tissue of the modern economy, and legalized in one fashion or another. However, central banks will be looking for a response, i.e., introducing their own digital currencies.

No digital currency of any central bank has been fully launched so far, although many countries have announced the practical stage. I think that the first digital currencies will be introduced in a year or two. Russia’s stance is important here: the Central Bank is wary of the process, but they do realize that they may lose the race if they fail to join the general process soon enough.

The leader is the People’s Bank of China with their digital Yuan. The bank has its own agenda: the national digital currency is an alternative method of bringing the Yuan to international markets and strengthen its positions in the global economy.

In view of the sanctions against Russia, this also applies to Russia. I’m sure that those developing the concept of the digital Ruble keep these issues in mind. That again means global competition of currencies – both Bitcoin and altcoins will remain in the competition and, given their limited supply, may continue to go up for some time.

- Is an alternative to classical money in the form of a cryptocurrency good for the economy?

- Competition is normally considered a good thing, but history says that it’s not always true. The Bitcoin related processes have been within limits so far. But if there is a crisis related to cryptocurrencies, there will be attempts to regulate the system.

The scale of Bitcoin circulation isn’t that large for the time being. Ifs we multiply the total number of Bitcoins by the value of one Bitcoin, we’ll see a significant amount of money. But remember that Bitcoins are mostly not in circulation. Some Bitcoin wallets have been lost; there is no movement in many others – so the amount is hard to know because the owners of particular wallets cannot be found. For the time being, this is a growing market, which not so significant globally to cause some crisis shocks.

Such shocks may occur though, because the situation so far is consistent with the theory of financial bubbles: first there is a mania, people invest enthusiastically, the price skyrockets, and then comes a crash. This is common and is likely to happen with cryptocurrencies as well.

Photo: Nikolay Mokhnachev / Scientific Russia

- Why didn’t it happen in the 12 years that Bitcoin has existed?

- Bitcoin was half-awake for some time; it did not develop. The active phase started in 2017. That’s when Bitcoin started slowly integrating, went up for the first time, and then dropped. Bitcoin cost less back then, so the recession was not that significant. Now, when Bitcoin is rising sharply, a slump will be felt more acutely.

For the time being, it’s a technology that has a future and certain advantages: anonymity and lower transaction costs. Official digital currencies will also have some of those advantages. After that, the potential of Bitcoin may dry up little by little.

- How has the pandemic affected the economy, including the digital economy?

- The economy has, clearly, lost a lot. The losses are already higher than those caused by the previous global crisis, while the current crisis isn’t over yet. Among other things, the losses included some voluntary costs that national governments incurred to protect the health of their citizens. It was a moment when safety considerations were more important than the economy.

There is a direct connection with the dynamics of Bitcoin – the pandemic boosted the digital economy. Those technologies are going to develop further, e.g., when banks had to operate remotely, that made them launch digital services, and this field will expand.

We are used to say “Bitcoin” but there is a much broader range of applications of digital technologies. They keep penetrating all branches of the economy – it’s an ongoing process.

This interview was conducted with the support from the Ministry of Science and Higher Education of the Russian Federation and the Russian Academy of Sciences.